The Russian stock market is going through the most difficult times

The Russian stock market is going through the most difficult times since the start of the global financial crisis. Sheer drop, which began with the beginning of this year, continues. Investors are interested in only one question: Where the bottom?

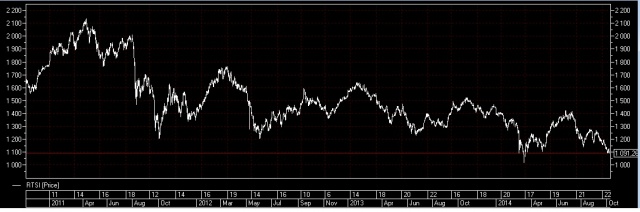

It is worth noting that the ruble MICEX index still shows signs of life, and is located approximately in the middle of the trading range, formed in 2011, But at the RTS dollar index picture is much more sad. The gradual decline has been going on for more than three years. During this time the benchmark many times to hit the level of 1200 points and every time I went up. It was not until this year, but in March of this support was still broken. Many market participants have become accustomed to the idea that the breakdown of this important level later in life in the RTS index is not there. However, in May, have developed good external conditions, and speculators began to break up the Russian market, and that, in principle, there was a sense, because in the summer to pay dividends, and purchasing shares at low prices, could derail a good sum due to the growth market, so and by dividend yield.

At this, apparently, positive history RTS coming to an end. Further sanctions followed, after which the market has not been raised. Gradually moved up and other negative events: the rapidly falling oil prices, a stronger dollar and wheel until the pile falling stock market the United States.

As a result, the RTS again broke through the level of 1200 points, then tried to get to the surface, but eventually confidently went below and is now trading has even below the level of 1100 points. Willing to buy is not observed, as the economic situation deteriorates, and hence the financial performance of companies will stagnate. Against this background, some experts predict that the index will fall far below the mark of 1000 points, somewhere in the region of 700 points. The arguments for such forecasts is the comparative dynamics of the RTS index and the price of oil, and it does point to the possibility of negative developments.

Already in the Russian interest there is little, but if the dollar index will fall even lower, it will mean the end of life of the Russian stock market. Given that the financial unit of the Russian government is preparing for the hard times in the next 2-3 years, then talk about the growth of the shares is not necessary. Most of the “blue chip” is aimed at the foreign market, and there are now serious changes. Trade with Europe declining, and in general the whole world economy is showing a slowdown. This is evidenced by recent reports from the IMF, and macroeconomic statistics.

Save the Russian market in the current environment could mitigate the sanctions by the West. It would be enough to somehow ease the restrictions on the ability to raise capital, but given how things are going in the Ukraine, the hope is unavailable. Nor was it in principle, since it is obvious that Ukraine – it’s just an excuse for the imposition of sanctions.

By the way, it is possible that the Russian market below try not to fall, but will simply live somewhere in a narrow range. Market makers will just carry it periodically up and down. If we compare the behavior of the market in the spring of this year, then it could be seen almost prohibitive trading volumes. It was obvious that someone was buying, but now it is not. Volumes, to put it mildly, is not impressive.