Where the USD / JPY pair will finish this year ?: Review and Forecast of JP Morgan

JP Morgan raises its outlook for the pair USD / JPY.

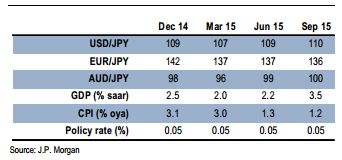

“Our forecast for December 2014 has been adjusted upwards to the level of 106 to 109 While we maintain our forecast for March 2015 at around 107, the forecast for June 2015 was increased to 109 from 107, and our new forecast for September 2015 is 110, “- said the JPM.

JPM identifies three reasons for this adjustment:

1 The main reason was the aggressive foreign investment by Japanese investors.

2 Another reason for the revision of the forecast for the USD / JPY became more psychological rather than economic factors.

3 The third reason was the increase in the trade deficit – Japan’s trade deficit reached ¥ 8.6 trillion, which is 47% higher than a year ago.

However, according to JPM, downside risk may lead pair falling to the level of 95, if implemented at least one of these scenarios:

1) jump in market volatility could trigger large-scale Deleveraging; potential pulses for this is the sharp slowdown in the world economy, the confusion in the financial system of China and the worsening of Russian-Ukrainian conflict;

2) Recent developments in inflation will motivate a more aggressive tone of the Bank of Japan and the Federal Reserve Bank more peaceful tone.

In contrast, the upside risk may stimulate the growth of the USD / JPY to around 115, if implemented even used one of the following scenarios:

1) domestic investors will increase the volume of redemption of foreign assets, even at current levels, USD / JPY;

2) inflation in Japan accelerated more than expected, consistently outperforming the United States and the euro area;

3) rapid recovery the United States, exceeding forecasts, lead to a jump in Treasury yields, which will contribute to strengthening USD.